Financial consolidation has emerged as a critical yet challenging task for businesses operating across multiple entities and currencies in the digital era. Traditionally bogged down by manual data entry and complex spreadsheet formulas, this process demands significant time and precision. Reach Reporting introduces a game-changing solution designed to automate and streamline financial consolidation. By simplifying this complex process, Reach Reporting enables businesses to focus on strategic growth and decision-making, heralding a new era of efficiency and accuracy in financial management.

The Challenge of Financial Consolidation

Financial consolidation for companies with multiple entities and currencies traditionally involves labor-intensive manual data entry and complex spreadsheets. This process is time-consuming and prone to errors, affecting the accuracy of financial reporting. The intricacies of handling diverse accounts, intercompany transactions, and currency conversions further complicate the consolidation process, presenting significant challenges for finance teams aiming to produce timely and precise financial statements.

Automated Consolidation with Reach Reporting

Reach Reporting revolutionizes financial consolidation by automating the process. This eliminates manual data entry and spreadsheet complexities, making consolidation efficient and accurate. The software employs advanced account matching technology, ensuring that accounts with the same names and categories across different entities are consolidated correctly. This speeds up the consolidation process and significantly enhances its accuracy, providing finance teams with a reliable foundation for financial reporting and analysis.

Simplifying Eliminations

Reach Reporting simplifies the financial consolidation process by automating the elimination of intercompany transactions. These transactions, common among affiliated entities, can distort the true financial position of a consolidated entity. The software efficiently identifies and zeros out these transactions, ensuring that the consolidated financial statements accurately reflect the company’s financial health without the misleading effects of internal dealings. This feature is crucial for maintaining the integrity of financial reports in a multi-entity environment.

Multi-Currency Conversion Made Easy

Reach Reporting handles the complex task of multi-currency conversion with ease. The software automatically converts financial data from multiple entities into a common reporting currency, applying historical exchange rates for accuracy. This feature is essential for businesses operating internationally, as it simplifies the consolidation process across different currencies, ensuring that financial statements accurately represent the company’s global operations without the need for manual currency conversion efforts.

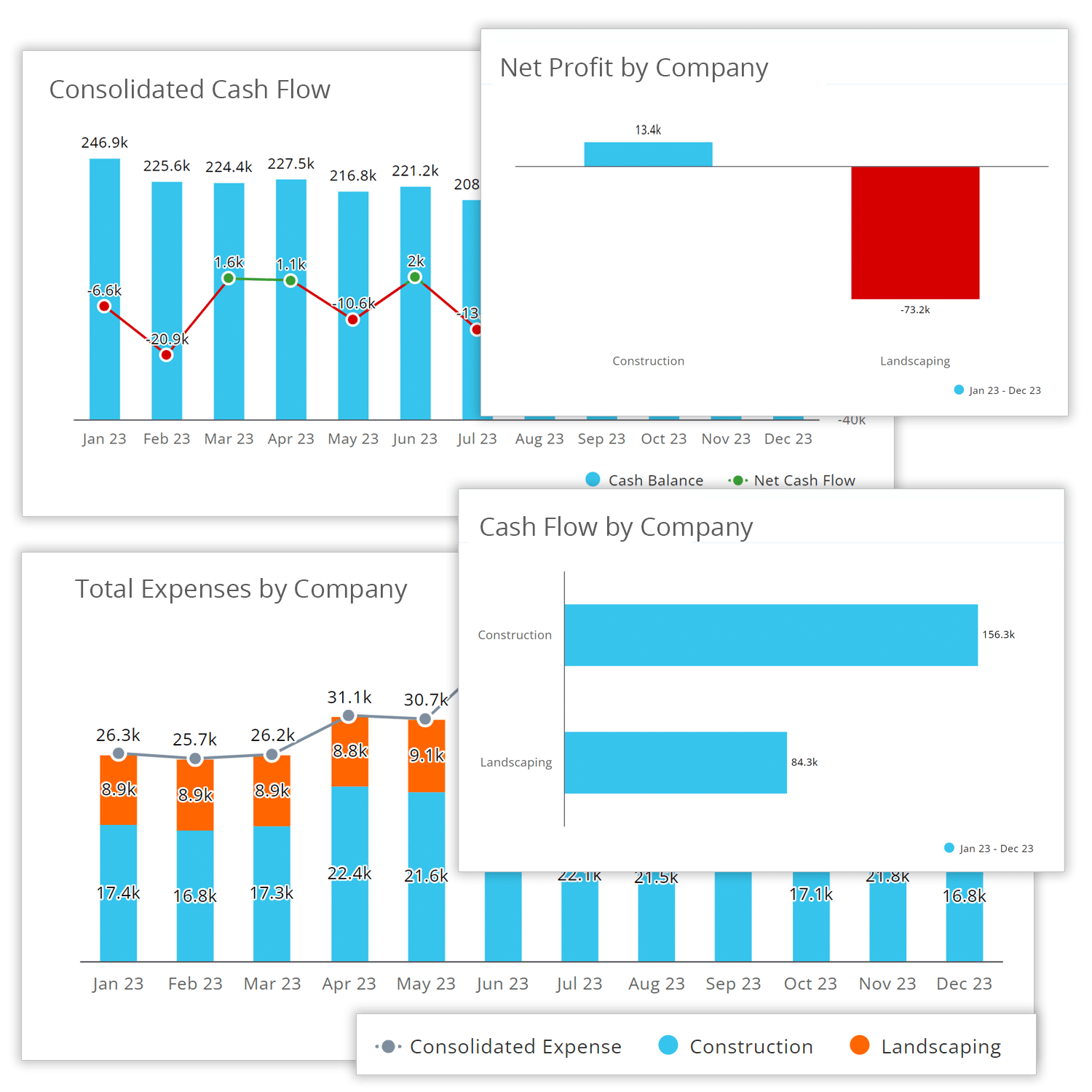

Analyze & Drill Down for Deeper Insights

Reach Reporting empowers users to analyze financial data on a consolidated level, offering professional-looking insights for actual and budget data. The software allows for a detailed drill-down from the consolidated figures to individual company levels, enabling precise analysis. Users can filter data by classes, departments, and locations, facilitating a comprehensive understanding of the financials and aiding in identifying the root causes of financial outcomes. This feature enhances strategic decision-making by providing deep, actionable insights.

Addressing Balancing Differences

Reach Reporting accurately addresses currency translation differences to ensure the integrity of consolidated financial statements. It allows for managing Foreign Currency Translation Reserves (FCTR) through custom row calculations or selective account eliminations. This feature ensures that financial statements remain accurate and reflect the true financial position, accounting for fluctuations in currency exchange rates and their impact on financial reporting.

User-Friendly Interface

Reach Reporting is designed with a user-friendly interface, ensuring financial consolidation is accessible to finance teams of all skill levels. This intuitive design minimizes the learning curve and facilitates a seamless experience in managing financial data. The emphasis on user experience makes it possible for teams to leverage the full potential of the software without extensive training, enhancing efficiency and productivity in financial reporting processes.

Streamlined Scalability

Reach Reporting is built to scale alongside your business, accommodating growth by allowing for the easy addition or removal of companies in the consolidation process. This scalability ensures that your financial consolidation system grows with you as your business expands, maintaining efficiency and accuracy without system changes or upgrades. This adaptability is critical for companies looking to scale operations without compromising financial reporting quality or operational efficiency.

Clear Consolidated Insights

Reach Reporting transforms the financial consolidation process with a powerful, user-friendly solution that manages the complexities of multi-company and multi-currency consolidation effortlessly. It provides a comprehensive view of the group’s overall financial health, enabling businesses to easily navigate the challenges of operating in diverse environments. This clarity and insight allow for informed decision-making, ensuring financial leaders have the necessary tools to effectively understand and act on their consolidated financial data.

Reach Reporting significantly simplifies the financial consolidation process, making it more efficient and accurate for businesses operating across multiple entities and currencies. By offering automated consolidation, easy eliminations, multi-currency conversion, and insightful analytics within a user-friendly interface, it stands as an essential tool for finance teams. This scalable solution saves time and provides clear, consolidated insights, empowering businesses to make informed decisions and focus on strategic growth.