Franchise owners, advisors, and CFOs face a complex landscape of financial oversight and regulatory compliance. The Federal Trade Commission’s (FTC) amended Franchise Rule, effective since July 1, 2008, sets strict standards for transparency and accuracy in franchise disclosures. At Reach Reporting, we empower franchise professionals to meet these requirements effortlessly while driving data-driven growth. This blog explores key insights from the FTC’s Franchise Rule Compliance Guide and shows how our tools align with these mandates to streamline your franchise operations.

Understanding Franchise Disclosure Requirements

The amended Franchise Rule requires franchisors to provide prospective franchisees with material information—background on the franchisor, costs, legal obligations, and outlet statistics—before any sale. As the FTC guide notes: “Like the original Franchise Rule and the UFOC Guidelines, the amended Rule requires franchisors to give prospective franchisees material information, including… audited financial information” (Page 3). Reach Reporting simplifies this by integrating with platforms like QuickBooks and Xero to deliver accurate, consolidated financial data across multiple locations.

- Real-Time Visibility: Track financial health across all franchise units instantly.

- Automated Consolidation: Aggregate data seamlessly for a unified view, ensuring compliance-ready reports.

Financial Performance Representations: Accuracy Matters

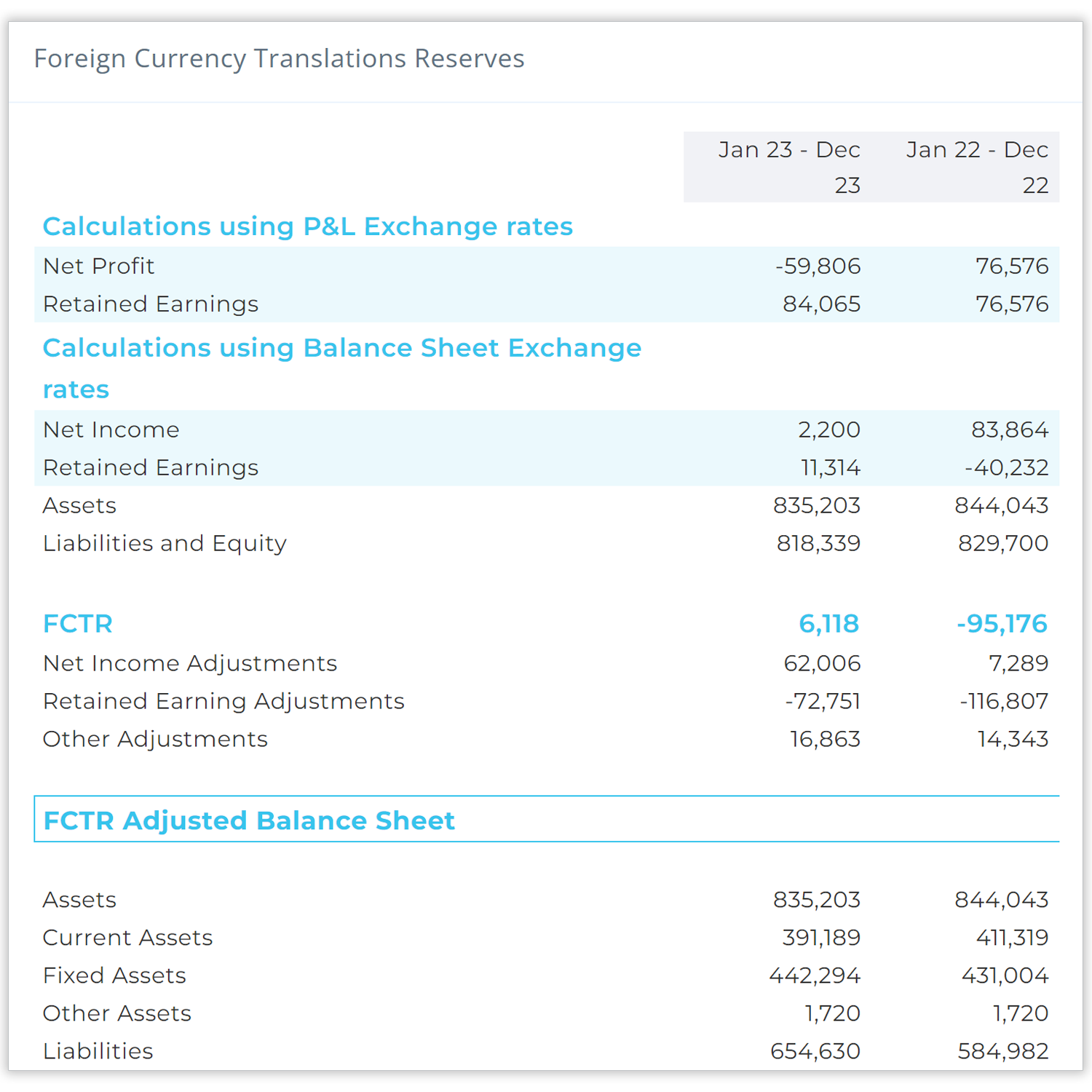

One of the amended Rule’s standout updates is its focus on financial performance representations (FPRs). The FTC guide defines an FPR as “any representation… that states, expressly or by implication, a specific level or range of actual or potential sales, income, gross profits, or net profits” (Page 130). It mandates that these claims be truthful, substantiated with written data, and included in Item 19 of the disclosure document. Reach Reporting ensures your FPRs are both accurate and compliant by providing robust tools to substantiate performance data.

For example, the guide advises: “The data underlying a historic performance representation must be subject to independent examination and verification… reasonably support[ing] the representation as it is likely to be understood by a reasonable prospective franchisee” (Page 136). With Reach Reporting’s real-time dashboards and customizable KPI tracking, you can generate substantiated reports—like revenue per unit or net profit trends—that meet these standards. Learn more in our Customization feature.

- Substantiation Made Simple: Pull verified data from integrated sources to back your claims.

- Clear Reporting: Include admonitions that “a new franchisee’s results may differ,” as required (Page 130).

Keeping Disclosures Current: Annual and Quarterly Updates

The FTC emphasizes timely updates to disclosure documents: “Franchisors must ensure that their disclosure documents are accurate and up to date… After the close of each fiscal year, a franchisor must update its disclosure document… within 120 days” (Page 126). Quarterly updates are also required for material changes, such as bankruptcy filings or significant lawsuits (Page 126). Reach Reporting’s automation features make this a breeze, ensuring you’re always audit-ready.

- Annual Updates: Generate updated financials in minutes with integrated data.

- Quarterly Precision: Reflect material changes instantly without manual rework.

Multi-State and Electronic Disclosures: Flexibility Meets Compliance

The amended Rule supports modern franchising needs: “Franchisors may prepare multi-state disclosure documents… included in the text or in attachments to Item 22” (Page 123) and permits “disclosures made via electronic media… identical to documents furnished in ‘hard copy’” (Page 122). Reach Reporting aligns perfectly, offering scalable, cloud-based solutions for multi-unit franchises and secure electronic reporting.

- Multi-State Reporting: Consolidate data for all locations, tailored to state-specific needs.

- Electronic Delivery: Share branded, compliant reports via a password-protected platform.

Why Choose Reach Reporting for Franchise Compliance?

The amended Rule’s focus on transparency—“prohibiting franchise sellers from making any statement that contradicts the information disclosed” (Page 138)—underscores the need for reliable tools. Reach Reporting delivers:

- For Owners: Clear profitability insights for expansion decisions.

- For Advisors: Automated forecasts to impress clients.

- For CFOs: Data-driven strategies across the franchise network.

Conclusion

Compliance doesn’t have to be a burden. With Reach Reporting, you meet the FTC’s standards while fueling growth with real-time insights and automation. Discover the power of Reach Reporting for Franchises today and transform how you approach financial reporting and planning!